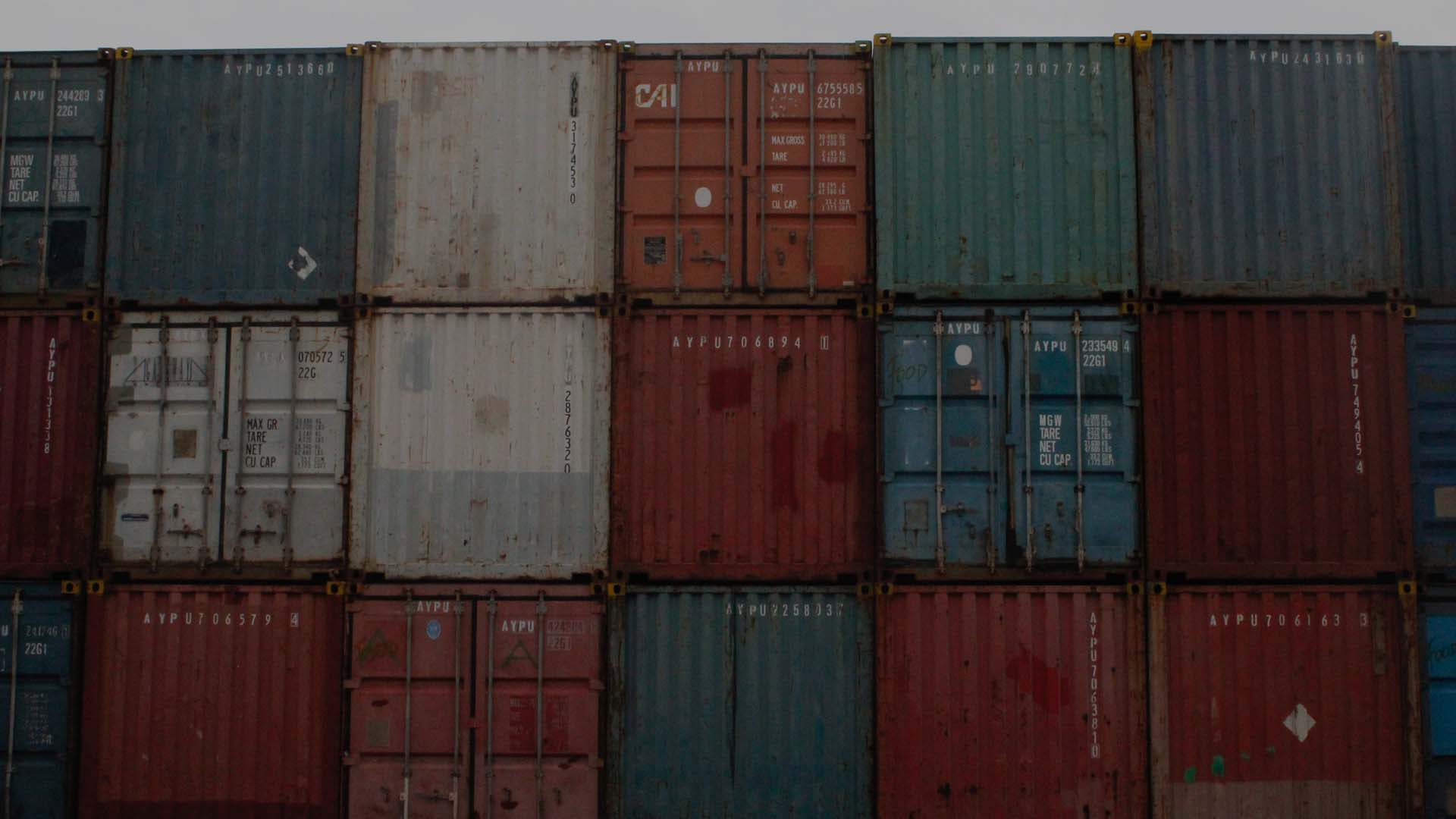

The retention of goods in customs is an inconvenience and an extra expense for companies. In the import and export sector, any delay in the delivery can lead to an economic loss. It is for this reason that it’s interesting to try to reduce or solve them as soon as possible.

How does customs clearance work?

To carry out any intervention, it is necessary to know how customs operations and processes work.

There are three different stages:

- Goods Declaration

The customs agent presents the goods documentation and acts as an intermediary in the declaration procedures on behalf of the exporter.

- Verification of the goods

The customs authority assigns a channel to the goods based on the viability of the documentation presented:

- Green Channel. It implies that the documentation is correct and that it automatically passes customs.

- Yellow channel. The documentation is not complete and more data is needed.

- Orange channel. It implies a documentary recognition and verification of each of the data provided.

- Red Channel. The customs authority requires checking the physical goods, since the documentation is not sufficient. Therefore, the customs process is delayed.

- Release of goods from customs clearance

Once the corresponding review has been carried out, customs releases the shipment. As this happens, you can continue the process of transporting it to its destination.

Why are goods stuck in customs?

As explained above, there are two main reasons that can stop a customs inspection: the lack of documentation or the irregularity of the goods.

However, other reasons may be:

Goods undervaluation

This case occurs when the supplier puts an estimated price of the product below than what its real value would be. This situation is very common in some Chinese sellers, who mark very low product values, and it is something very controlled and persecuted by Customs.

Taxes

Many times, when buying products from another country, the price does not include the corresponding tax, such as VAT, since they do not have that tax there. When introducing these products, if they are retained, you must pay the corresponding tax and other expenses related to a series of customs procedures, such as handling costs, storage and administrative costs of the post office.

Special permissions

Some products require certain special permits, such as toys, medicines, agricultural products or used vehicles, among others. If any product is imported that needs these special permits, and it lacks it, it will be retained at Customs.

It is important to bear in mind that all the documentation and specific certificates must be provided to customs, in case of not having them, the goods may be destroyed at the owner’s expense.

Bulky goods

For security reasons, Customs is likely to retain those packages that have excessively bulky dimensions.

Suspicious or dangerous goods

And finally, goods that may seem suspicious or dangerous, those that may look like a gun or some other type of weapon, even if they are harmless, or that under your control have to pay another tax, can also be retained at Customs.

How to release a shipment in customs

One of the key aspects to unblock retained goods is the intermediary between the client and customs. This organization mediates to represent the interests of the end customer and streamline processes. For this reason, it is essential to have a serious and competent service.

At PINEXPORTS we offer all our productions free of customs procedures for our clients. As manufacturers of the merchandise, we are responsible for it at all times and exempt our clients from any responsibility.

If you have questions or want to know how we work, contact us without obligation.